How to Buy Virtual Visa Card with Bkash , Nagad , Rocket : Simplifying Online Transactions

Table of Contents

Intro :

Online purchases have made safe and simple payment options essential. Bkash-purchased virtual Visa cards are common. This thorough tutorial covers virtual Visa card perks, capabilities, and seamless connection with the Bkash, Nagad, and Rocket platforms.

Buy Virtual Visa Card with Bkash 🇧🇩

How to Buy Virtual Visa Card with Bkash , nagad , Rocket : Simplifying Online Transactions

Virtual Visa Cards: Features and Benefits

Virtual Visa cards simplify online buying and provide several benefits.

### 1\. Safe and encrypted transactions

Encryption protects your personal and financial information with virtual Visa cards. Shop with confidence, knowing your card information is protected from hackers or data breaches.

### 2\. Wide adoption on e-commerce platforms

Virtual Visa cards are accepted on many e-commerce platforms, which is a major advantage. Your virtual Visa card will be accepted on Amazon, eBay, and other online retailers, making online shopping easy.

### 3\. International purchase flexibility

International purchases are flexible with virtual Visa cards. Forget currency exchanges and typical payment methods. Making purchases from overseas websites is easy with a virtual Visa card, expanding your choices and possibilities.

### B. Easy Load/Reload

Virtual Visa cards make loading and recharging money easy and flexible.

#### 1\. Knowledge of funding possibilities

Bank transfers, credit/debit card transactions, and mobile wallets like Bkash may fund virtual Visa cards. This flexibility lets you choose the optimal financing solution for your requirements.

#### 2\. Step-by-step instructions for putting money into the virtual Visa card.

Funding a virtual Visa card is easy. Log into your BKash account and load money onto your virtual Visa card. Select the amount and funding source to load. Your virtual Visa card will have the money immediately when the transaction is verified.

#### 3\. Automatic reloading for convenience

Virtual Visa cards allow automated reloading for convenience. If your balance drops below a certain level, your card will automatically reload with the predefined amount. This way, you never run out of money while shopping online.

### C. Increased Security

Virtual Visa cards emphasize security and further secure transactions.

#### 1\. Two-factor authentication for safe transactions

Using two-factor authentication, virtual Visa cards increase security. You’ll need to input your card information and a unique code, normally provided to your registered cellphone number or email. This additional protection guarantees that only you may approve virtual Visa card transactions.

2. Coverage for fraud and liability

Virtual Visa cards provide full fraud and liability coverage. If unlawful transactions or fraud occur, you will not be accountable. Visa’s sophisticated security systems and protocols detect and prevent fraudulent transactions, ensuring online purchasing security.

#### 3. Control and monitoring for transaction tracking

Virtual Visa cards allow you to monitor and regulate internet transactions. Tracking spending, seeing transaction history, and setting spending limitations to remain within budget is easy. These tools let you manage your money and purchase online without anxiety.

### D. Cost-effectiveness and Finance

Virtual Visa cards are cost-effective and help you manage your finances.

#### 1: Fewer transaction fees than standard cards

Virtual Visa cards provide lower transaction costs than regular payment options. Traditional credit and debit cards may accrue high fees. Virtual Visa cards let you purchase online without worrying about overspending.

2. Budgeting and spending restrictions improve financial management.

Budgeting and spending constraints are included in virtual Visa cards. These tools let you establish spending limitations for categories or periods to remain on budget and financially disciplined. Actively managing your budget helps you avoid impulsive purchases and make better online purchases.

#### 3\. Prepaid virtual Visa card for debt avoidance

Prepaid virtual Visa cards provide another financial benefit. Only the amounts deposited onto the card may be used, reducing the possibility of debt. A virtual Visa card lets you purchase online without collecting credit card debt.

### E. Mobile wallet and digital banking integration

Virtual Visa cards work with mobile wallets like Bkash, improving online payments.

#### 1\. Virtual Visa card-bkash wallet link

You may simplify your digital payments by adding your virtual Visa card to your bkash wallet. Use your phone to access your virtual Visa card credentials and make safe payments with a few clicks.

#### 2: Trying alternative Visa-compatible digital payments

Bkash integration is not the only virtual Visa card feature. They can also connect to PayPal, Google Pay, and Apple Pay. You may pick the digital payment platform that suits you best, providing you greater control over online purchases.

#### 3: Adding features and benefits via integration

Integrating your virtual Visa card with digital payment systems adds capabilities and benefits. For select purchases, your virtual Visa card may provide unique discounts, cashback, or reward points. Explore these integration advantages to enhance savings and value when buying online.

Virtual Visa Card Purchase with Bkash: Step-by-Step Guide

After discussing virtual Visa cards’ merits, let’s purchase one using bkash.

- Choosing the correct virtual Visa card

Determine the ideal virtual Visa card by considering your requirements and preferences. Choose the card that meets your needs, whether it’s a single-use, reloadable, or spending-limited card.

- Starting the buy with bkash

After selecting a virtual Visa card, go into your bkash account and visit the virtual Visa card area. Purchase alternatives are here.

- Verifying and providing personal information

Verification and personal information are needed to complete the transaction. This contains your name, address, contact information, and occasionally a valid ID.

- Verifying the transaction and obtaining virtual Visa card data

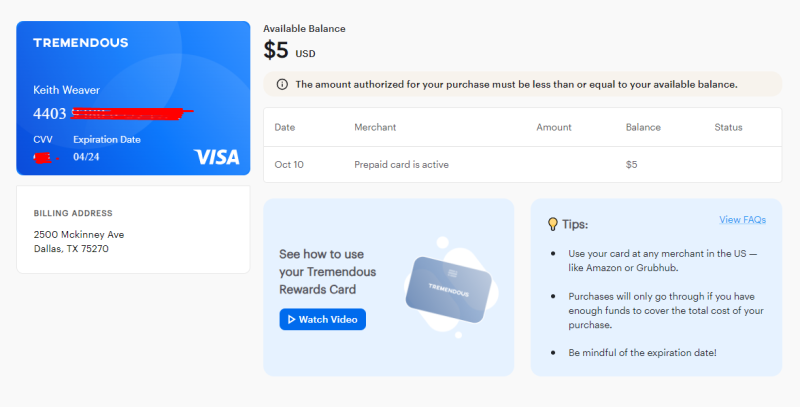

Review transaction details and confirm the purchase after inputting personal information. The virtual Visa card number, expiry date, and CVV code will be sent when the transaction is completed.

- Using the virtual Visa card for online payments

To activate your virtual Visa card, follow Bkash’s instructions. After activating your card, you may pay online. Enter your card information at checkout on your chosen online retailer’s website for a secure and simple buying experience.

Top Tips for Using Virtual Visa Cards with Bkash

Consider these strategies and best practices to maximize your virtual Visa card and bkash integration:

- Update virtual Visa card information regularly for security.

Update your virtual Visa card information frequently for security. Your CVV code, expiry date, and card may need to be replaced. You reduce the danger of fraudulent transactions and provide the greatest degree of online purchase security by doing so.

- Maintaining transaction records and statements

Track your virtual Visa card’s transactions and statements to stay organized. This lets you track your spending, spot inconsistencies, and understand your internet transactions. To simplify this, several virtual Visa card companies provide user-friendly interfaces and mobile applications.

- Using offers and incentives for further advantages

Use your virtual Visa card rewards and offers. Check for discounts, rebates, and reward programs to save more. You may maximize online purchases by using these features.

- Limitations and limits for a smooth experience

Check your virtual Visa card and bkash integration constraints. This might include transaction limitations, merchant category restrictions, or foreign purchasing rules. Understanding these restrictions makes internet purchasing easy.

- Following bkash channels for updates and new features

Keep up with virtual Visa card and bkash integration upgrades and features. Regularly monitor the bkash website or social media platforms for updates that might improve your online transaction experience. Being proactive and educated lets you maximize integration advantages.

Summary: Virtual Visa Cards and bkash Simplify Online Transactions

Virtual Visa cards ease online transactions in today’s digital world. From easy online shopping to improved security, virtual Visa cards provide convenience and peace of mind. Integration with systems like bkash gives these virtual Visa cards a complete solution that meets current consumer expectations. Why not try bkash’s virtual Visa cards today?

Frequently asked questions

- How safe are online virtual Visa cards?

For safe online transactions, virtual Visa cards include encryption, two-factor authentication, and fraud prevention.

- Are virtual Visa cards valid for foreign purchases?

Virtual Visa cards allow international purchases. Your virtual Visa card lets you purchase on worldwide e-commerce sites.

- Do Visa cards with bkash incur extra fees?

Virtual Visa cards often have minimal or no transaction fees, but check the terms and conditions before using them with bkash.

- What if I lose my virtual Visa card information?

If you lose your virtual Visa card information, call the supplier or bkash immediately. They will help you safeguard your account and get a new card.

- Can I attach numerous virtual Visa cards to bkash?

What We Offer

We offer virtual Prepaid balance bank cards that allow you to pay for goods and services anonymously online. We work worldwide so you can purchase virtual prepaid balance from anywhere in the world and use them to pay online on any websites that accept prepaid balances.

Token Service

Token Service provides financial institutions, merchants and value-added partners with a consolidated payment platform. With a complete set of token management tools, interfaces and risk controls, Token Service secures mobile and digital transactions on connected devices.

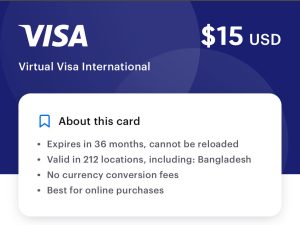

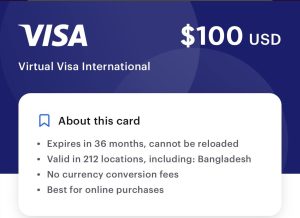

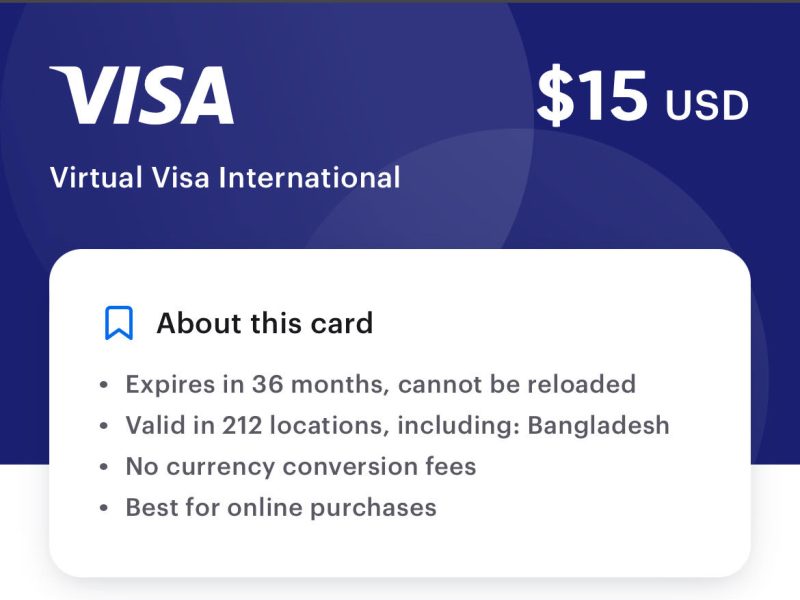

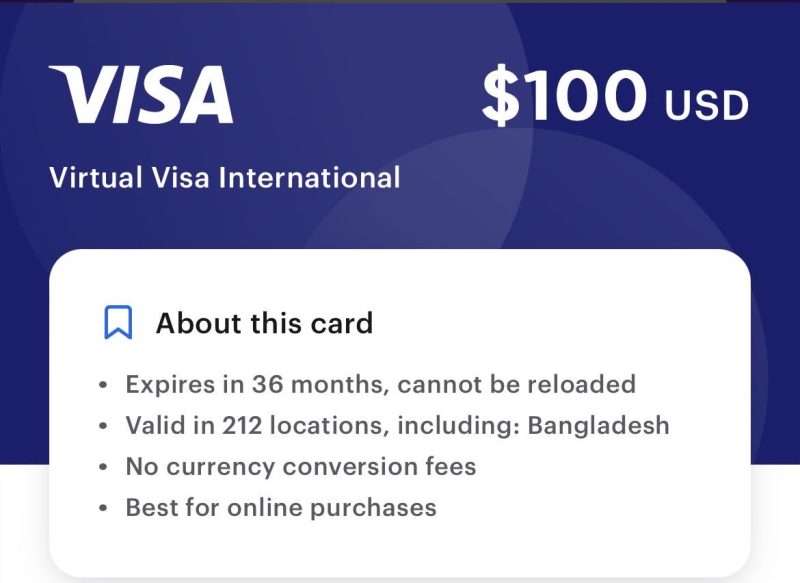

Virtual Visa Card Price in Bangladesh

Digital Enablement Programme:

Safest Virtual Visa Card for facebook boosting Price in BD

Are prepaid balances secure?

Prepaid Balances are safer than cash, typically allowing you to recover your money if your card is lost or stolen.

*The dashboard balances Wildlife Impact gift card is issued by Sunrise Banks N.A., Member FDIC, pursuant to a license from Master Prepaid Card International Incorporated. . Master Prepaid Card is a registered trademark, and the circles design is a trademark, of Master Prepaid card International Incorporated. Use of this card constitutes acceptance of the terms and conditions stated in the Cardholder Agreement.

The underlying funds do not expire. An inactivity fee of $4.95 per month will be deducted from your balance beginning on the 13th month after each 12-month period of inactivity.

Checkout

By 2018, eCommerce and mCommerce sales are projected to reach over $620B.2 Checkout enhances payment acceptance online by giving shoppers the convenience of storing payment information behind a single log in – that means they can pay without entering their delivery and account information every time.

2 Source: Mobile commerce trends, eMarketer, July 24, 2014

Cheap Virtual Visa Card Price in BD

In conclusion, the $5 , $10, $15 , $20 and so on Visa Tremendous Credit Card from Shopvian is a budget-friendly solution for those who want the convenience of a credit card without the burden of high fees and credit limits. With the ability to use it for Facebook boosting and various other online transactions, it opens up a world of possibilities for individuals and businesses alike. Say goodbye to complicated credit checks and hello to financial flexibility with this fantastic $5 credit card. Get yours today and start enjoying the benefits of a virtual credit card designed to meet your needs without breaking the bank!

#virtualcreditcardbangladesh

#freevirtualmastercard

#virtualmastercardfree

#virtualmastercardfree

#buyvirtualvisacardwithbkash

#getfreevirtualmastercard

#createfreevirtualmastercard

#buyvirtualvisacardwithbkash

Reviews

There are no reviews yet.